Our Legal Plans are available in

British-Columbia, Alberta, Saskatchewan, Manitoba, and Ontario.To continue, please select your desired province from the dropdown menu:

Our Legal Plans are available in

British-Columbia, Alberta, Saskatchewan, Manitoba, and Ontario.To continue, please select your desired province from the dropdown menu:

Knowing that your affairs will be taken care of when you can’t take care of them yourself is reassuring.

Whether you become permanently incapacitated or just temporarily unable to make important decisions, having a Power of Attorney that allows a family member or other trusted advisor to make sound medical and financial decisions is a critical part of a comprehensive estate plan.

View plan details

Creating a Will on your own can be overwhelming and time-consuming. Also, without the help of a lawyer, you may never be sure you followed the law correctly and that a court will honour your wishes. Most lawyers charge an average of $1,500 dollars to draft a basic Will and estate plan. There is a better option.

Get a personal legal plan from LegalShield starting at $49.95 per month and you get a Will, Living Will/Advanced Directive and Power of Attorney created by an experienced estate planning lawyer within 5 days of completing our Will Worksheet. It’s the simple, stress-free way to cross this critical item off your task list.

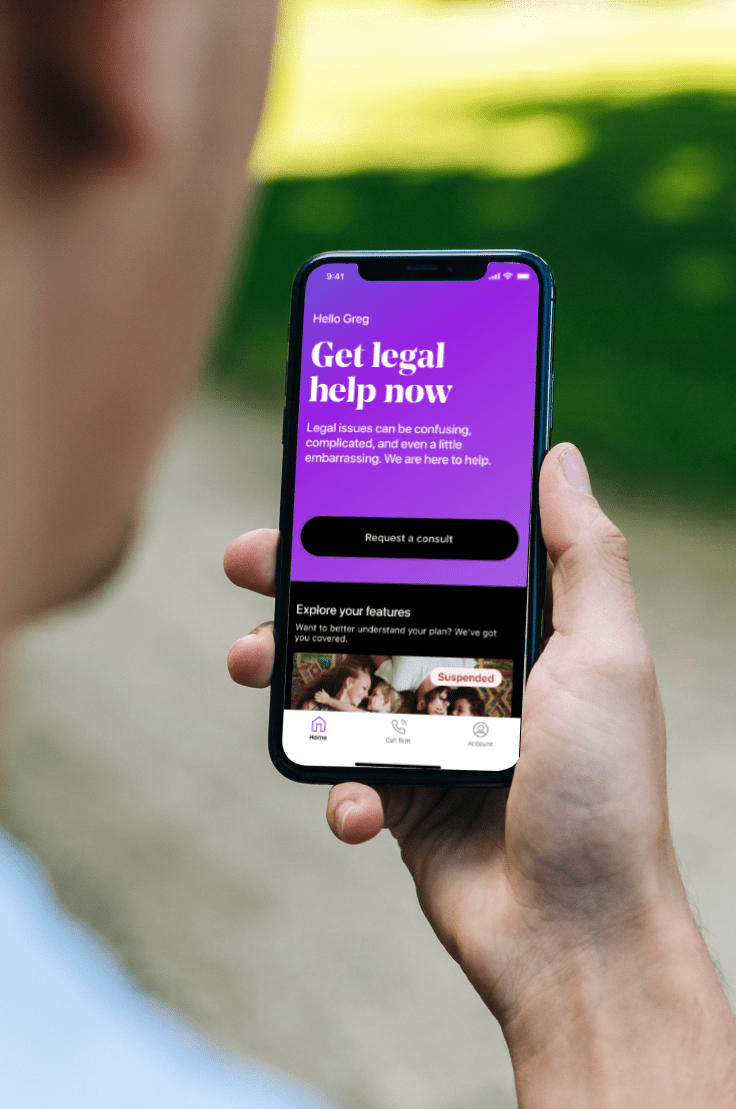

Legal issues can be confusing, complicated, and even a little embarrassing. Save time, save money, and protect yourself and your family with a legal plan today. Here’s how it works.

Sign up for your Personal Legal Plan, and then head to accounts.legalshield.com to set up your account. Be sure to add your spouse and dependant children.

Download our app, it’s like having a lawyer in your pocket. Our customer service agents are available 24/7 to help guide you.

From the app you can choose to call your law firm, submit a traffic ticket, start your Will or other documents, request emergency legal help, and more. It’s that easy.

Personal LegalShield Plans Start at Only $49.95 Per Month

Explore more topics