Our Legal Plans are available in

British-Columbia, Alberta, Saskatchewan, Manitoba, and Ontario.To continue, please select your desired province from the dropdown menu:

Our Legal Plans are available in

British-Columbia, Alberta, Saskatchewan, Manitoba, and Ontario.To continue, please select your desired province from the dropdown menu:

Trusts may be set up as part of an estate plan for several reasons. For example, a Living Trust can help with estate tax issues, help avoid Probate and address certain family circumstances. A Living Trust is a Trust that is established during lifetime. It distributes assets similar to a Will.

Avoiding probate can save your family both time and money. However, if your Living Trust is not set up properly and your assets have not been correctly transferred to it, your good intentions may be in vain.

View plan details >

Without a proper Estate Plan, your assets – that is, your money, your home, anything you own – will be tied up in the probate court system.

Probate can take up to 2 years to resolve an estate, running up legal bills of more than $12,000, on average. Transferring assets to a trust allows them to pass without the hassle of probate. Trusts are a powerful tool to avoid probate and are available for estates of any size.

Creating a Will on your own can be overwhelming and time-consuming. Also, without the help of a lawyer, you may never be sure you followed the law correctly and that a court will honour your wishes. Most lawyers charge an average of $1,500 dollars to draft a basic Will and estate plan. There is a better option.

Get a personal legal plan from LegalShield starting at $49.95 per month and you get a Will, Living Will/Advanced Directive and Power of Attorney created by an experienced estate planning lawyer within 5 days of completing our Will Worksheet. It’s the simple, stress-free way to cross this critical item off your task list.

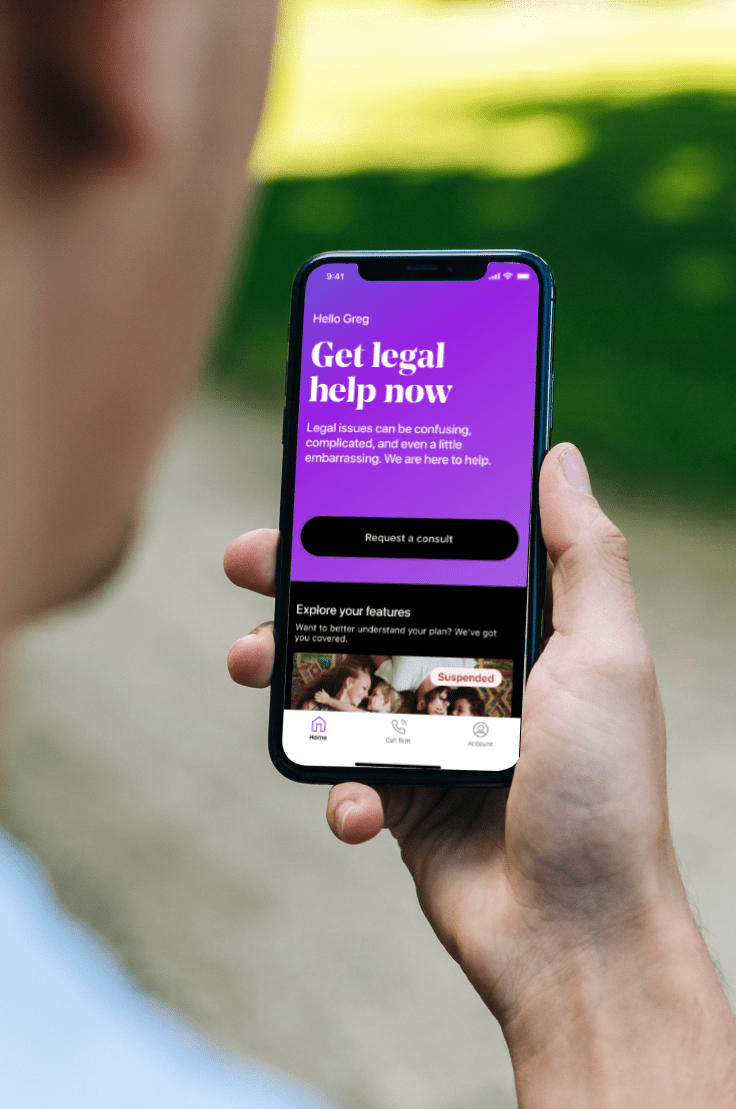

Legal issues can be confusing, complicated, and even a little embarrassing. Save time, save money, and protect yourself and your family with a legal plan today. Here’s how it works.

Sign up for your Personal Legal Plan, and then head to accounts.legalshield.com to set up your account. Be sure to add your spouse and dependant children.

Download our app, it’s like having a lawyer in your pocket. Our customer service agents are available 24/7 to help guide you.

From the app you can choose to call your law firm, submit a traffic ticket, start your Will or other documents, request emergency legal help, and more. It’s that easy.

Family Plans start at only $49.95 per month.

Explore more topics